Do you know your business credit score?

Risk Free

Check your business credit score without it having a negative impact

Safe and Secure

Our secure platform means all your information is safe

Fast and free

No cost, no obligation. Get your business credit score immediately

Know your Score

Your business credit score can provide you with a sense of the financial position of your business. Your credit score is one of the indicators used by banks and lenders in assessing the risk of lending to your business. Typically in the United Kingdom, your credit score is negatively impacted each time you check it through a lender or bank. With Bufton’s ‘Know Your Score’, you can check your business credit score without leaving a footprint. This way, you can establish the health of your business without the risk of lowering your business credit score!

‘Know Your Score’ is absolutely free, secure and immediate. Simply provide your company details and your score will be provided there and then, by Equifax. Once you receive your business credit score, there is no obligation to apply for a loan from Bufton, or any other financial services provider. Bufton will apply our credit assessment, which will differ from your free Equifax business credit score.

Building a strong credit profile

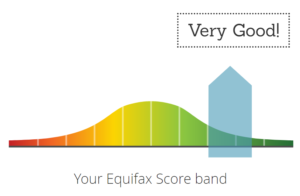

Your business credit score is a numeric value between 0-1200, and is derived from your business credit profile. Your credit profile contains additional information about your business’s credit history, so it’s important to build a strong credit profile.

Here are some tips to help you build your credit profile:

- Make sure your profile is accurate – the credit bureaus offer dispute resolution processes to remedy any verifiable incorrect information contained in your report.

- Establish trade accounts with your suppliers – leverage 30- or 60- day payment terms, but be sure to stick to the agreed upon terms.

- Use the credit you need and stay current – avoiding credit altogether can make it hard for lenders to assess your business, financially, but be sure to only use credit as needed.

- Keep your personal and business credit separate – mixing the two can have a negative impact on both your personal and business credit reports.

Credit scores are broken into categories, ranging from Poor (0-509) to Excellent (833-1200):

One-Third of business’s that used Know Your Score have an “Excellent” business credit score, with 769 as the average score*.